Page 83 - MA - May 2017

P. 83

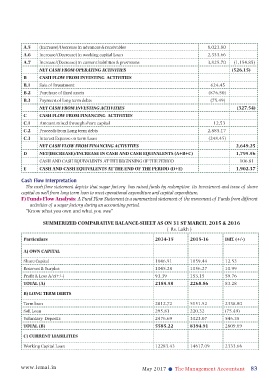

A.5 (Increase)/Decrease in advances & receivables 8,023.80

A.6 Increase/(Decrease) in working capital Loan 2,333.66

A.7 Increase/(Decrease) in current liabilities & provisions 3,825.70 (1,154.85)

NET CASH FROM OPERATING ACTIVITIES (526.15)

B CASH FLOW FROM INVESTING ACTIVITIES

B.1 Sale of Investment 624.45

B.2 Purchase of fixed assets (876.50)

B.3 Payment of long term debts (75.49)

NET CASH FROM INVESTING ACTIVITIES (327.54)

C CASH FLOW FROM FINANCING ACTIVITIES

C.1 Amount raised through share capital 12.53

C.2 Proceeds from Long term debts 2,885.17

C.3 Interest Expense on term Loan (248.45)

NET CASH FLOW FROM FINANCING ACTIVITIES 2,649.25

D NET(DECREASE)/INCREASE IN CASH AND CASH EQUIVALENTS (A+B+C) 1,795.56

CASH AND CASH EQUIVALENTS AT THE BEGINNING OF THE PERIOD 106.81

E CASH AND CASH EQUIVALENTS AT THE END OF THE PERIOD (D+E) 1,902.37

Cash Flow Interpretation

The cash flow statement depicts that sugar factory has raised funds by redemption its Investment and issue of share

capital as well from long term loan to meet operational expenditure and capital expenditure.

F) Funds Flow Analysis: A Fund Flow Statement is a summarized statement of the movement of Funds from different

activities of a sugar factory during an accounting period.

“Know what you own and what you owe”

SUMMERIZED COMPARATIVE BALANCE-SHEET AS ON 31 ST MARCH, 2015 & 2016

( Rs. Lakh )

Particulars 2014-15 2015-16 Diff. (+/-)

A) OWN CAPITAL

Share Capital 1046.91 1059.44 12.53

Reserves & Surplus 1045.28 1056.27 10.99

Profit & Loss A/c(+/-) 93.39 153.15 59.76

TOTAL (A) 2185.58 2268.86 83.28

B) LONG TERM DEBTS

Term loan 2812.72 5151.52 2338.80

Soft Loan 295.81 220.32 (75.49)

Voluntary Deposits 2476.69 3023.07 546.38

TOTAL (B) 5585.22 8394.91 2809.69

C) CURRENT LIABILITIES

Working Capital Loan 12283.43 14617.09 2333.66

www.icmai.in May 2017 l The Management Accountant 83