Page 82 - MA - May 2017

P. 82

CASE STUDY

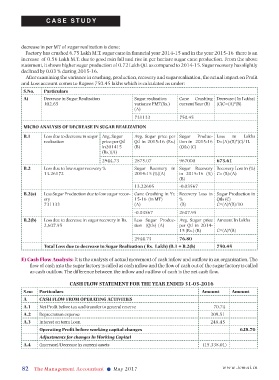

decrease in per MT of sugar realization is done:

Factory has crushed 6.75 Lakh M.T. sugar cane in financial year 2014-15 and in the year 2015-16 there is an

increase of 0.56 Lakh M.T. due to good rain fall and rise in per hectare sugar cane production. From the above

statement, it shows higher sugar production of 0.72 Lakh Qtl. as compared to 2014-15. Sugar recovery has slightly

declined by 0.03 % during 2015-16.

After examining the variance in crushing, production, recovery and sugar realization, the actual impact on Profit

and Loss account comes to Rupees 750.45 lakhs which is calculated as under:

S.No. Particulars

A) Decrease in Sugar Realization Sugar realization Cane Crushing Decrease ( In Lakhs)

102.65 variance PMT(Rs.) current Year (B) (C)C=(A)*(B)

(A)

731133 750.45

MICRO ANALYSIS OF DECREASE IN SUGAR REALIZATION

B.1 Loss due to decrease in sugar Avg. Sugar Avg. Sugar price per Sugar Produc- Loss in Lakhs

realization price per Qtl Qtl in 2015-16 (Rs.) tion in 2015-16 D=(A)-(B)*(C)/1L

in201415 (B) (Qtls) (C)

(Rs.)(A)

2944.73 2875.07 967000 673.61

B.2 Loss due to low sugar recovery % Sugar Recovery in Sugar Recovery Recovery Loss in (%)

13.26172 2014-15 (%)(A) in 2015-16 (%) C= (B)-(A)

(B)

13.22605 -0.03567

B.2(a) Less Sugar Production due to low sugar recov- Cane Crushing in Yr. Recovery Loss in Sugar Production in

ery 15-16 (in MT) % Qtls (C)

731133 (A) (B) C=(A)*(B)/10

-0.03567 2607.95

B.2(b) Loss due to decrease in sugar recovery in Rs. Less Sugar Produc- Avg. Sugar price Amount In Lakhs

2,607.95 tion (Qtls) (A) per Qtl in 2014-

15 (Rs.) (B) C=(A)*(B)

2944.73 76.80

Total Loss due to decrease in Sugar Realization ( Rs. Lakh) (B.1 + B.2(b) 750.45

E) Cash Flow Analysis: It is the analysis of actual movement of cash inflow and outflow in an organization. The

flow of cash into the sugar factory is called as cash inflow and the flow of cash out of the sugar factory is called

as cash outflow. The difference between the inflow and outflow of cash is the net cash flow.

CASH FLOW STATEMENT FOR THE YEAR ENDED 31-03-2016

S.no Particulars Amount Amount

A CASH FLOW FROM OPERATING ACTIVITIES

A.1 Net Profit before tax and transfer to general reserve 70.74

A.2 Depreciation expense 309.51

A.3 Interest on term Loan 248.45

Operating Profit before working capital changes 628.70

Adjustments for changes In Working Capital

A.4 (Increase)/Decrease in current assets (15,338.01)

82 The Management Accountant l May 2017 www.icmai.in