Page 79 - MA - May 2017

P. 79

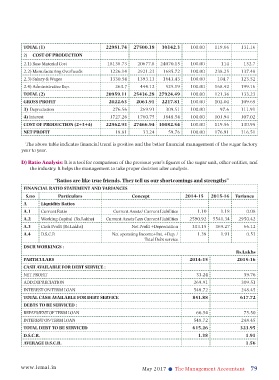

TOTAL (1) 22981.74 27500.18 30142.3 100.00 119.66 131.16

2) COST OF PRODUCTION

2.1) Raw Material Cost 18138.73 20677.8 24070.15 100.00 114 132.7

2.2) Manufacturing Overheads 1226.14 2921.23 1685.72 100.00 238.25 137.48

2.3) Salary & Wages 1330.54 1393.13 1643.43 100.00 104.7 123.52

2.4) Administrative Exp. 263.7 444.12 525.19 100.00 168.42 199.16

TOTAL (2) 20959.11 25436.28 27924.49 100.00 121.36 133.23

GROSS PROFIT 2022.63 2063.91 2217.81 100.00 102.04 109.65

3) Depreciation 276.56 269.91 309.51 100.00 97.6 111.91

4) Interest 1727.26 1760.75 1848.54 100.00 101.94 107.02

COST OF PRODUCTION (2+3+4) 22962.93 27466.94 30082.54 100.00 119.56 130.95

NET PROFIT 18.81 33.24 59.76 100.00 176.91 316.51

The above table indicates financial trend is positive and the better financial management of the sugar factory

year to year.

D) Ratio Analysis: It is a tool for comparison of the previous year’s figures of the sugar unit, other entities, and

the industry. It helps the management to take proper decision after analysis.

“Ratios are like true friends. They tell us our shortcomings and strengths”

FINANCIAL RATIO STATEMENT AND VARIANCES

S.no Particulars Concept 2014-15 2015-16 Variance

A Liquidity Ratios

A.1 Current Ratio Current Assets/ Current Liabilities 1.10 1.18 0.08

A.2 Working Capital (Rs.Lakhs) Current Assets Less Current Liabilities 2590.92 5541.34 2950.42

A.3 Cash Profit (Rs.Lakhs) Net Profit +Depreciation 303.15 369.27 66.12

A.4 D.S.C.R Net operating Income+Int. +Dep. / 1.38 1.91 0.53

Total Debt service

DSCR WORKINGS :

Rs.Lakhs

PARTICULARS 2014-15 2015-16

CASH AVAILABLE FOR DEBT SERVICE :

NET PROFIT 33.24 59.76

ADD:DEPRECIATION 269.91 309.51

INTEREST ON TERM LOAN 548.72 248.45

TOTAL CASH AVAILABLE FOR DEBT SERVICE 851.88 617.72

DEBTS TO BE SERVICED :

REP AYMENT OF TERM LOAN 66.54 75.50

INTEREST ON TERM LOAN 548.72 248.45

TOTAL DEBT TO BE SERVICED 615.26 323.95

D.S.C.R. 1.38 1.91

AVERAGE D.S.C.R. 1.56

www.icmai.in May 2017 l The Management Accountant 79