Page 81 - MA - May 2017

P. 81

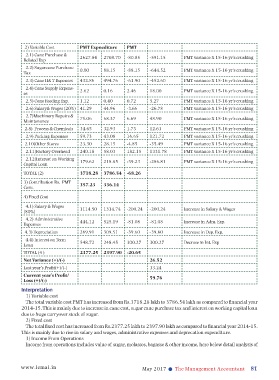

2) Variable Cost PMT Expnediture PMT

2.1) Cane Purchase & 2627.84 2708.70 -80.85 -591.15 PMT variance X 15-16 yr’s crushing

Related Exp

2.2) Sugarcane Purchase 0.00 88.15 -88.15 -644.52 PMT variance X 15-16 yr’s crushing

Tax

2.3) Cane H& T Expenses 432.86 494.76 -61.90 -452.60 PMT variance X 15-16 yr’s crushing

2.4) Cane Supply Expens- 2.62 0.16 2.46 18.00 PMT variance X 15-16 yr’s crushing

es

2.5) Cane Feeding Exp. 1.12 0.40 0.72 5.27 PMT variance X 15-16 yr’s crushing

2.6) Salary& Wages (20%) 41.29 44.96 -3.66 -26.78 PMT variance X 15-16 yr’s crushing

2.7)Machinery Repairs & 75.06 68.37 6.69 48.90 PMT variance X 15-16 yr’s crushing

Maintenance

2.8) Process & Chemicals 34.65 32.93 1.73 12.63 PMT variance X 15-16 yr’s crushing

2.9) Packing Expenses 59.73 43.08 16.65 121.72 PMT variance X 15-16 yr’s crushing

2.10)Other Stores 23.30 28.15 -4.85 -35.49 PMT variance X 15-16 yr’s crushing

2.11)Factory Overhead 240.18 58.03 182.15 1331.78 PMT variance X 15-16 yr’s crushing

2.12)Interest on Working 179.62 218.85 -39.23 -286.81 PMT variance X 15-16 yr’s crushing

Capital Loan

TOTAL (2) 3718.28 3786.54 -68.26

3) Contribution Rs. PMT 357.23 336.14

Cane

4) Fixed Cost

4.1) Salary & Wages 1114.50 1314.74 -200.24 -200.24 Increase in Salary & Wages

(80%)

4.2) Administrative 444.12 525.19 -81.08 -81.08 Increase in Adm. Exp.

Expenses

4.3) Depreciation 269.91 309.51 -39.60 -39.60 Increase in Dep. Exp.

4.4) Interest on Term 548.72 248.45 300.27 300.27 Decrase in Int. Exp

Loan

TOTAL (4 ) 2377.25 2397.90 -20.65

Net Variance (+)/(-) 26.52

Last year’s Profit(+)/(-) 33.24

Current year’s Profit/ 59.76

Loss (+)/(-)

Interpretation

1) Variable cost

The total variable cost PMT has increased from Rs.3718.28 lakh to 3786.54 lakh as compared to financial year

2014-15. This is mainly due to increase in cane cost, sugar cane purchase tax and interest on working capital loan

due to huge carryover stock of sugar.

2) Fixed cost

The total fixed cost has increased from Rs.2377.25 lakh to 2397.90 lakh as compared to financial year 2014-15.

This is mainly due to rise in salary and wages, administrative expenses and deprecation expenditure.

3) Income From Operations

Income from operations includes value of sugar, molasses, bagasse & other income, here below detail analysis of

www.icmai.in May 2017 l The Management Accountant 81