Page 85 - MA - May 2017

P. 85

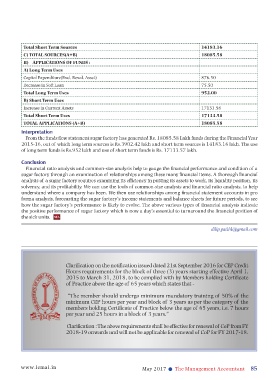

Total Short Term Sources 14183.16

C) TOTAL SOURCES(A+B) 18085.58

II) APPLICATIONS OF FUNDS :

A) Long Term Uses

Capital Expenditure(Excl. Reval. Asset) 876.50

Decrease in Soft Loan 75.50

Total Long Term Uses 952.00

B) Short Term Uses

Increase in Current Assets 17133.58

Total Short Term Uses 17133.58

TOTAL APPLICATIONS (A+B) 18085.58

Interpretation

From the funds flow statement sugar factory has generated Rs. 18085.58 Lakh funds during the Financial Year

2015-16, out of which long term sources is Rs.3902.42 lakh and short term sources is 14183.16 lakh. The use

of long term funds is Rs.952 lakh and use of short term funds is Rs. 17133.57 lakh.

Conclusion

Financial ratio analysis and common-size analysis help to gauge the financial performance and condition of a

sugar factory through an examination of relationships among these many financial items. A thorough financial

analysis of a sugar factory requires examining its efficiency in putting its assets to work, its liquidity position, its

solvency, and its profitability. We can use the tools of common-size analysis and financial ratio analysis, to help

understand where a company has been. We then use relationships among financial statement accounts in pro

forma analysis, forecasting the sugar factory’s income statements and balance sheets for future periods, to see

how the sugar factory’s performance is likely to evolve. The above various types of financial analysis indicate

the positive performance of sugar factory which is now a day’s essential to turnaround the financial position of

the sick units.

dilip.patil4@gmail.com

Clarification on the notification issued dated 21st September 2016 for CEP Credit

Hours requirements for the block of three (3) years starting effective April 1,

2015 to March 31, 2018, to be complied with by Members holding Certificate

of Practice above the age of 65 years which states that -

“The member should undergo minimum mandatory training of 50% of the

minimum CEP hours per year and block of 3 years as per the category of the

members holding Certificate of Practice below the age of 65 years, i.e. 7 hours

per year and 25 hours in a block of 3 years.”

Clarification : The above requirements shall be effective for renewal of CoP from FY

2018-19 onwards and will not be applicable for renewal of CoP for FY 2017-18.

www.icmai.in May 2017 l The Management Accountant 85