Page 97 - MA - May 2017

P. 97

Kritika & Vikas Choudhary (2015) As regard the impact of board size on firm performance the results suggest

that for ROE (statistically significant)

It can be concluded that ROE can be considered as one of the measures to evaluate companies or firms

performances. It should not be kept isolated.

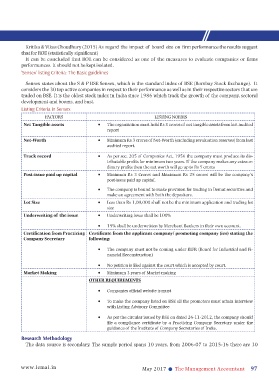

‘Sensex’ listing Criteria: The Basic guidelines

Sensex states about the S & P BSE Sensex, which is the standard index of BSE (Bombay Stock Exchange). It

considers the 30 top active companies in respect to their performance as well as in their respective sectors that are

traded on BSE. It is the oldest stock index in India since 1986 which track the growth of the company, sectoral

development and booms, and bust.

Listing Criteria in Sensex

FACTORS LISTING NORMS

Net Tangible assets • The organisation must hold Rs 3 crores of net tangible assets from last audited

report

Net-Worth • Minimum Rs 3 crores of Net-Worth (excluding revaluation reserves) from last

audited report.

Track record • As per sec. 205 of Companies Act, 1956 the company must produce its dis-

tributable profits for minimum two years. If the company makes any extraor-

dinary profits then the net worth will go up to Rs 5 crores

Post-issue paid up capital • Minimum Rs 3 Crores and Maximum Rs 25 crores will be the company’s

post-issue paid up capital.

• The company is bound to make provision for trading in Demat securities and

make an agreement with both the depositors.

Lot Size • Less than Rs 1,00,000 shall not be the minimum application and trading lot

size

Underwriting of the issue • Underwriting issue shall be 100%

• 15% shall be underwritten by Merchant Bankers in their own account.

Certification from Practicing Certificate from the applicant company/ promoting company (ies) stating the

Company Secretary following:

• The company must not be coming under BIFR (Board for Industrial and Fi-

nancial Reconstruction)

• No petition is filed against the court which is accepted by court.

Market Making • Minimum 3 years of Market making

OTHER REQUIREMENTS

• Companies official website is must

• To make the company listed on BSE all the promoters must attain interview

with Listing Advisory Committee

• As per the circular issued by BSE on dated 26-11-2012, the company should

file a compliance certificate by a Practicing Company Secretary under the

guidance of the Institute of Company Secretaries of India.

Research Methodology

The data source is secondary. The sample period spans 10 years, from 2006-07 to 2015-16 there are 30

www.icmai.in May 2017 l The Management Accountant 97