Page 68 - MA - May 2017

P. 68

FINANCIAL MANAGEMENT

Total Count 69 69 69 69 276

Expected Count 69.0 69.0 69.0 69.0 276.0

% within Motivations 25.0% 25.0% 25.0% 25.0% 100.0%

% within Rank 100.0% 100.0% 100.0% 100.0% 100.0%

% of Total 25.0% 25.0% 25.0% 25.0% 100.0%

Table-5

Symmetric Measures

Value Approx. Sig.

Phi 0.715 0.000

Nominal by Nominal

Cramer’s V 0.413 0.000

N of Valid Cases 276

Which derivative contracts companies are mostly using for hedging?

Through this question, we have tried to get response from the respondents about the use of important financial

derivative contracts by companies in India. For that, we have taken four of important derivative contracts for

obtaining responses.

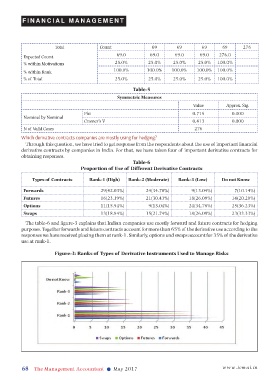

Table-6

Proportion of Use of Different Derivative Contracts

Types of Contracts Rank-1 (High) Rank-2 (Moderate) Rank-3 (Low) Do not Know

Forwards 29(42.03%) 24(34.78%) 9(13.04%) 7(10.14%)

Futures 16(23.19%) 21(30.43%) 18(26.09%) 14(20.29%)

Options 11(15.94%) 9(13.04%) 24(34.78%) 25(36.23%)

Swaps 13(18.84%) 15(21.74%) 18(26.09%) 23(33.33%)

The table-6 and figure-3 explains that Indian companies use mostly forward and future contracts for hedging

purposes. Together forwards and future contracts account for more than 65% of the derivative use according to the

responses we have received placing them at rank-1. Similarly, options and swaps account for 35% of the derivative

use at rank-1.

Figure-3: Ranks of Types of Derivative Instruments Used to Manage Risks

68 The Management Accountant l May 2017 www.icmai.in