Page 72 - MA - May 2017

P. 72

FINANCIAL MANAGEMENT

Count 4 2 8 14

% within Concern 28.6% 14.3% 57.1% 100.0%

Pricing and valuing derivatives

% within Rank 5.8% 2.9% 11.6% 6.8%

% of Total 1.9% 1.0% 3.9% 6.8%

Count 2 0 5 7

% within Concern 28.6% 0.0% 71.4% 100.0%

Monitoring and evaluating hedge results

% within Rank 2.9% 0.0% 7.2% 3.4%

% of Total 1.0% 0.0% 2.4% 3.4%

Count 1 0 3 4

Evaluating the risk of proposed deriva- % within Concern 25.0% 0.0% 75.0% 100.0%

tives transactions % within Rank 1.4% 0.0% 4.3% 1.9%

% of Total 0.5% 0.0% 1.4% 1.9%

Total Count 69 69 69 207

% within Concern 33.3% 33.3% 33.3% 100.0%

% within Rank 100.0% 100.0% 100.0% 100.0%

% of Total 33.3% 33.3% 33.3% 100.0%

Ha2: There are concerns (apprehensions) for entities to use financial derivative as a risk management tool.

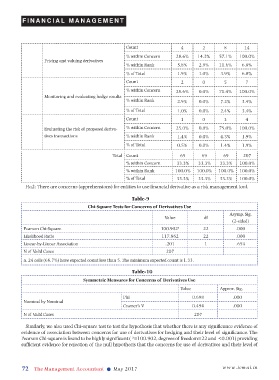

Table-9

Chi-Square Tests for Concerns of Derivatives Use

Asymp. Sig.

Value df

(2-sided)

Pearson Chi-Square 100.902 a 22 .000

Likelihood Ratio 117.862 22 .000

Linear-by-Linear Association .201 1 .654

N of Valid Cases 207

a. 24 cells (66.7%) have expected count less than 5. The minimum expected count is 1.33.

Table-10

Symmetric Measures for Concerns of Derivatives Use

Value Approx. Sig.

Phi 0.698 .000

Nominal by Nominal

Cramer’s V 0.494 .000

N of Valid Cases 207

Similarly, we also used Chi-square test to test the hypothesis that whether there is any significance evidence of

evidence of association between concerns for use of derivatives for hedging and their level of significance. The

Pearson Chi-square is found to be highly significant (²=100.902, degrees of freedom=22 and <0.001) providing

sufficient evidence for rejection of the null hypothesis that the concerns for use of derivatives and their level of

72 The Management Accountant l May 2017 www.icmai.in