Page 70 - MA - May 2017

P. 70

FINANCIAL MANAGEMENT

massive losses incurred by J.P. Morgan in 2012, which seem to have combined various measures of incompetence,

ignorance, failure to comply with financial regulations, and corruption. United States Senator Carl Levin, Chairman

of the Senate Subcommittee on Investigations, summarized the pervasive cynicism and concern when he stated:

‘‘Derivative values that cannot be trusted are a serious risk to our financial system’’ (14 March 2013).

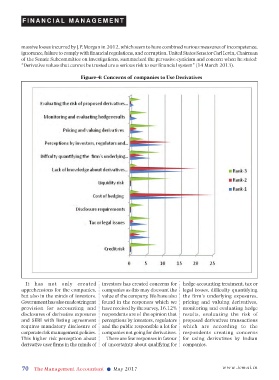

Figure-4: Concerns of companies to Use Derivatives

It has not only created investors has created concerns for hedge accounting treatment, tax or

apprehensions for the companies, companies as this may discount the legal issues, difficulty quantifying

but also in the minds of investors. value of the company. We have also the firm’s underlying exposures,

Government has also made stringent found in the responses which we pricing and valuing derivatives,

provision for accounting and have received by the survey, 16.12% monitoring and evaluating hedge

disclosures of derivative exposures respondents are of the opinion that results, evaluating the risk of

and SEBI with listing agreement perceptions by investors, regulators proposed derivatives transactions

requires mandatory disclosure of and the public responsible a lot for which are according to the

corporate risk management policies. companies not going for derivatives. respondents creating concerns

This higher risk perception about There are few responses in favour for using derivatives by Indian

derivative user firms in the minds of of uncertainty about qualifying for companies.

70 The Management Accountant l May 2017 www.icmai.in