Page 103 - MA - May 2017

P. 103

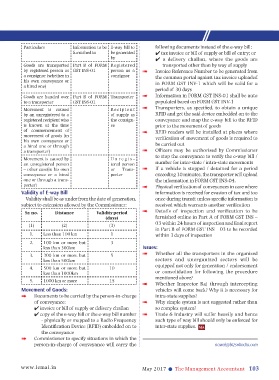

Particulars Information to be E-way bill to following documents instead of the e-way bill:

furnished in be generated tax invoice or bill of supply or bill of entry; or

by a delivery challan, where the goods are

Goods are transported Part B of FORM Registered transported other than by way of supply

by registered person as GST INS-01 person as a Invoice Reference Number to be generated from

a consignor (whether in consignor the common portal against tax invoice uploaded

his own conveyance or in FORM GST INV-1 which will be valid for a

a hired one)

period of 30 days

Goods are handed over Part B of FORM Transporter Information in FORM GST INS-01 shall be auto

to a transporter GST INS-01 populated based on FORM GST INV-1

Movement is caused Re c ip i en t Transporters, as specified, to obtain a unique

by an unregistered to a of supply as RFID and get the said device embedded on to the

registered recipient who the consign- conveyance and map the e-way bill to the RFID

is known at the time ee prior to the movement of goods

of commencement of RFID readers will be installed at places where

movement of goods (in verification of movement of goods is required to

his own conveyance or

a hired one or through be carried out

a transporter) Officers may be authorised by Commissioner

to stop the conveyance to verify the e-way bill /

Movement is caused by Unregis -

an unregistered person tered person number for inter-state / intra-state movements

– other case(in his own or Trans- If a vehicle is stopped / detained for a period

conveyance or a hired porter exceeding 30 minutes, the transporter will upload

one or through a trans- the information in FORM GST INS-04.

porter) Physical verification of conveyances in case where

Validity of E-way Bill information is received for evasion of tax and too

Validity shall be as under from the date of generation, once during transit unless specific information is

subject to extension allowed by the Commissioner: received which warrants another verification

Sr. no. Distance Validity period Details of inspection and verification to be

(days) furnished online in Part A of FORM GST INS –

03 within 24 hours of inspection and final report

(1) (2) (3)

in Part B of FORM GST INS – 03 to be recorded

1. Less than 100 km 1 within 3 days of inspection

2. 100 km or more but 3

less than 300km Issues:

3. 300 km or more but 5 Whether all the transporters in the organized

less than 500km sectors and unorganized sectors will be

equipped not only for generation / endorsement

4. 500 km or more but 10

less than 1000km or consolidation for following the procedure

mentioned above?

5. 1000 km or more 15

Whether Inspector Raj through intercepting

Movement of Goods: vehicles will come back? Why it is necessary for

Documents to be carried by the person-in-charge intra-state supplies?

of conveyance: Why simple system is not suggested rather than

invoice or bill of supply or delivery challan so complex system?

copy of the e-way bill or the e-way bill number Trade & Industry will suffer heavily and hence

- physically or mapped to a Radio Frequency such type of way bill should only be enforced for

Identification Device (RFID) embedded on to inter-state supplies.

the conveyance

Commissioner to specify situations in which the

person-in-charge of conveyance will carry the nawal@bizsolindia.com

www.icmai.in May 2017 l The Management Accountant 103