Page 24 - MA - May 2017

P. 24

COVER ST OR Y

model are given below. Example

Step 1: Determination of Cost of all products and The example explained below reveals the steps

services mentioned. In order to make easy understanding the

Step 2: The determination of the Profit of each example is restricted to only two products i.e. Product

A and Product B and only profit earned by the purely

products and services financial items during the account period under

Step 3: Apportionment of Purely Financial items consideration. The model could be extended to more

Step 4: Determination of overall profit. products and services and purely financial items for

Step 5: The identification of loss making products or the previous years also. In the model both Traditional

services and exploration of cost reduction costing method and Activity Based Costing method

techniques. were demonstrated.

Let us presume the present selling prices of the

Step 6: Explore the possibility of revising the Selling product is Rs 13 for the product A and Rs 27 for the

Price product B and there is sufficient demand in the market

Step 7: Determination of discontinuance of produce for the both products.

and services. The cost incurred for producing the Product A and

Product B are given below:-

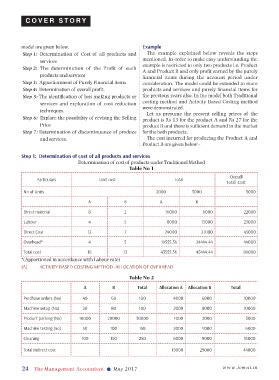

Step 1: Determination of cost of all products and services

Determination of cost of products under Traditional Method

Table No 1

Overall

Particulars Unit cost Total

Total Cost

No of Units 2000 3000 5000

A B A B

Direct material 8 2 16000 6000 22000

Labour 4 5 8000 15000 23000

Direct Cost 12 7 24000 21000 45000

Overhead* 4 5 19555.56 24444.44 44000

Total cost 16 12 43555.56 45444.44 89000

*(Apportioned in accordance with Labour rate)

(A) ACTIVITY BASED COSTING METHOD -ALLOCATION OF OVERHEAD

Table No 2

A B Total Allocation A Allocation B Total

Purchase orders (No) 40 60 100 4000 6000 10000

Machine setup (No) 20 80 100 2000 8000 10000

Product packing (No) 10000 20000 30000 1000 2000 3000

Machine testing (no) 50 100 150 2000 4000 6000

Cleaning 100 150 250 6000 9000 15000

Total Indirect cost 15000 29000 44000

24 The Management Accountant l May 2017 www.icmai.in