Page 25 - MA - May 2017

P. 25

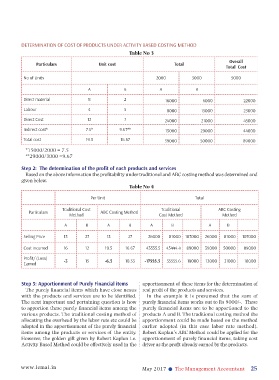

DETERMINATION OF COST OF PRODUCTS UNDER ACTIVITY BASED COSTING METHOD

Table No 3

Overall

Particulars Unit cost Total

Total Cost

No of Units 2000 3000 5000

A B A B

Direct material 8 2 16000 6000 22000

Labour 4 5 8000 15000 23000

Direct Cost 12 7 24000 21000 45000

Indirect cost* 7.5* 9.67** 15000 29000 44000

Total cost 19.5 16.67 39000 50000 89000

*15000/2000 = 7.5

**29000/3000 =9.67

Step 2: The determination of the profit of each products and services

Based on the above information the profitability under traditional and ABC costing method was determined and

given below.

Table No 4

Per Unit Total

Traditional Cost Traditional ABC Costing

Particulars ABC Costing Method

Method Cost Method Method

A B A B A B A B

Selling Price 13 27 13 27 26000 81000 107000 26000 81000 107000

Cost incurred 16 12 19.5 16.67 43555.5 45444.4 89000 39000 50000 89000

Profit/ (Loss) -3 15 -6.5 10.33 -17555.5 35555.6 18000 -13000 31000 18000

Earned

Step 3: Apportionment of Purely Financial items apportionment of these items for the determination of

The purely financial items which have close nexus real profit of the products and services.

with the products and services are to be identified. In the example it is presumed that the sum of

The next important and pertaining question is how purely financial items works out to Rs 9000/-. These

to apportion these purely financial items among the purely financial items are to be apportioned to the

various products. The traditional costing method of products A and B. The traditional costing method the

allocating the overhead by the labor rate etc could be apportionment could be made based on the method

adopted in the apportionment of the purely financial earlier adopted (in this case labor rate method).

items among the products or services of the entity. Robert Kaplan’s ABC Method could be applied for the

However, the golden gift given by Robert Kaplan i.e. apportionment of purely financial items, taking cost

Activity Based Method could be effectively used in the driver as the profit already earned by the products.

www.icmai.in May 2017 l The Management Accountant 25