Page 26 - MA - May 2017

P. 26

COVER ST OR Y

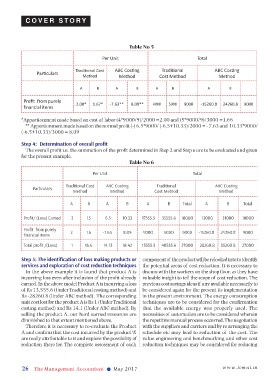

Table No 5

Per Unit Total

Traditional Cost ABC Costing Traditional ABC Costing

Particulars

Method Method Cost Method Method

A B A B A B A B

Profit from purely 2.00* 1.67* -7.63** 8.09** 9000 -15260.8 24260.8 9000

financial items 4000 5000

*Apportionment made based on cost of labor (4*9000/9)/2000 =2.00 and (5*9000/9)/3000 =1.66

** Apportionment made based on the normal profit (-) 6.5*9000/ (-6.5+10.33)/2000 = - 7.63 and 10.33*9000/

(-6.5+10.33)/3000 = 8.09

Step 4: Determination of overall profit

The overall profit i.e. the summation of the profit determined in Step 2 and Step e are to be evaluated and given

for the present example.

Table No 6

Per Unit Total

Traditional Cost ABC Costing Traditional ABC Costing

Particulars

Method Method Cost Method Method

A B A B A B Total A B Total

Profit/ (Loss) Earned -3 15 -6.5 10.33 -17555.5 35555.6 18000 -13000 31000 18000

Profit from purely

financial items 2 1.6 -7.63 8.09 4000 5000 9000 -15260.8 24260.8 9000

Total profit /(Loss) -1 16.6 -14.13 18.42 -13555.5 40555.6 27000 -28260.8 55260.8 27000

Step 5: The identification of loss making products or component of the product will be relooked into to identify

services and exploration of cost reduction techniques the potential areas of cost reduction. It is necessary to

In the above example it is found that product A is discuss with the workers on the shop floor, as they have

incurring loss even after inclusion of the profit already valuable insight to tell the scope of cost reduction. The

earned. In the above model Product A is incurring a loss previous cost savings ideas if any available necessarily to

of Rs 13,555.6 (Under Traditional costing method) and be considered again for the present its implementation

Rs -28260.8 (Under ABC method). The corresponding in the present environment. The energy consumption

unit cost lost for the product A is Rs 1 (Under Traditional techniques are to be considered for the confirmation

costing method) and Rs 14.1 (Under ABC method). By that the available energy was properly used. The

selling the product A, our hard earned resources are necessities of automation are to be considered wherein

diminished to that extent mentioned above. the repetitive manual process occurred. The negotiation

Therefore it is necessary to re-evaluate the Product with the suppliers and carriers and by re arranging the

A and confirm that the cost incurred by the product ‘A’ schedule etc may lead to reduction of the cost. The

are really attributable to it and explore the possibility of value engineering and benchmarking and other cost

reduction there for. The complete assessment of each reduction techniques may be considered for reducing

26 The Management Accountant l May 2017 www.icmai.in