Page 60 - MSME BULLETIN 2022 NEW LAYOUT 19082022.indd

P. 60

MSME & START-UP BULLETIN, VOLUME 1, ISSUE 1, AUGUST 2022

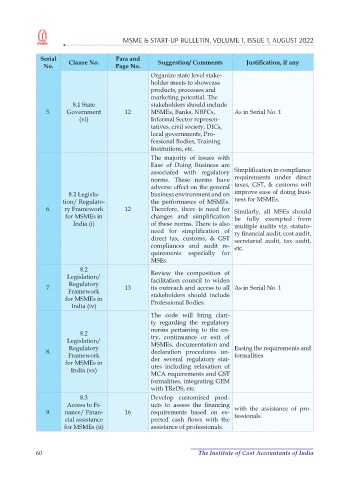

Serial Clause No. Para and Suggestion/ Comments Justification, if any

No. Page No.

Organize state level stake-

holder meets to showcase

products, processes and

marketing potential. The

8.1 State stakeholders should include

5. Government 12 MSMEs, Banks, NBFCs, As in Serial No. 1

(vi) Informal Sector represen-

tatives, civil society, DICs,

local governments, Pro-

fessional Bodies, Training

Institutions, etc.

The majority of issues with

Ease of Doing Business are

associated with regulatory Simplification in compliance

norms. These norms have requirements under direct

adverse effect on the general taxes, GST, & customs will

8.2 Legisla- business environment and on improve ease of doing busi-

tion/ Regulato- the performance of MSMEs. ness for MSMEs.

6. ry Framework 12 Therefore, there is need for Similarly, all MSEs should

for MSMEs in changes and simplification be fully exempted from

India (i) of these norms. There is also multiple audits viz. statuto-

need for simplification of ry financial audit, cost audit,

direct tax, customs, & GST secretarial audit, tax audit,

compliances and audit re- etc.

quirements especially for

MSEs.

8.2

Legislation/ Review the composition of

facilitation council to widen

Regulatory

7. 13 its outreach and access to all As in Serial No. 1

Framework

for MSMEs in stakeholders should include

Professional Bodies.

India (iv)

The code will bring clari-

ty regarding the regulatory

norms pertaining to the en-

8.2

Legislation/ try, continuance or exit of

MSMEs, documentation and

Regulatory Easing the requirements and

8. declaration procedures un-

Framework formalities

for MSMEs in der several regulatory stat-

utes including relaxation of

India (xx)

MCA requirements and GST

formalities, integrating GEM

with TReDS, etc.

8.3 Develop customised prod-

Access to Fi- ucts to assess the financing

9. nance/ Finan- 16 requirements based on ex- with the assistance of pro-

fessionals.

cial assistance pected cash flows with the

for MSMEs (ii) assistance of professionals.

60 The Institute of Cost Accountants of India